Cryptocurrency volatility— the reasons behind and risk management strategies

Zixuan Wang

Co-Presenters: Wang Zixuan, Zhang Wen

College: College of Business and Public Management

Major: Economics

Faculty Research Mentor: Chen Meng

Abstract:

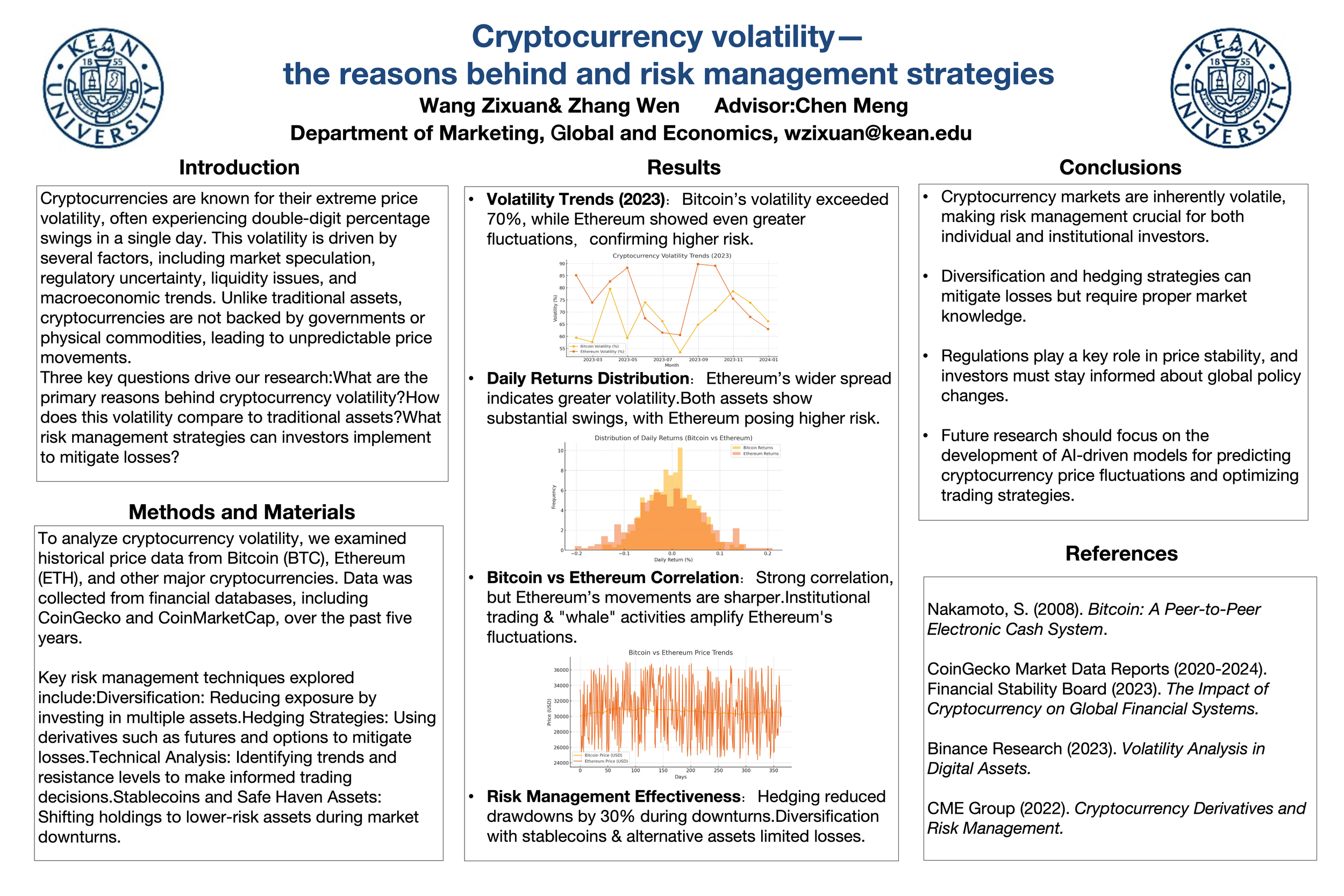

Renowned for their extreme volatility, cryptocurrencies often show quick and random price swings. This study investigates the main drivers of bitcoin volatility, compares it with conventional assets, and looks at sensible risk management strategies for readers. Using five years of historical data from well-known cryptocurrencies such Bitcoin and Ethereum, the study finds that the main causes of volatility are market speculation, regulatory uncertainty, liquidity difficulties, and macroeconomic elements.Ethereum demonstrates more pronounced price volatility compared to Bitcoin, driven by institutional trading and high-volume transactions. The study assesses multiple risk mitigation strategies—such as diversification, derivative hedging, and transitioning to stablecoins—and concludes that these methods can substantially diminish investment drawdowns. The study underscores the significance of educated decision-making in unstable markets and posits that forthcoming developments in AI-driven predictive models may further improve trading and risk management strategies.