The impact of the Fed's interest rate hike on the banking industry and financial markets

Yijie Wu

Co-Presenters: Individual Presentation

College: College of Business and Public Management

Major: Finance

Faculty Research Mentor: Chen Meng

Abstract:

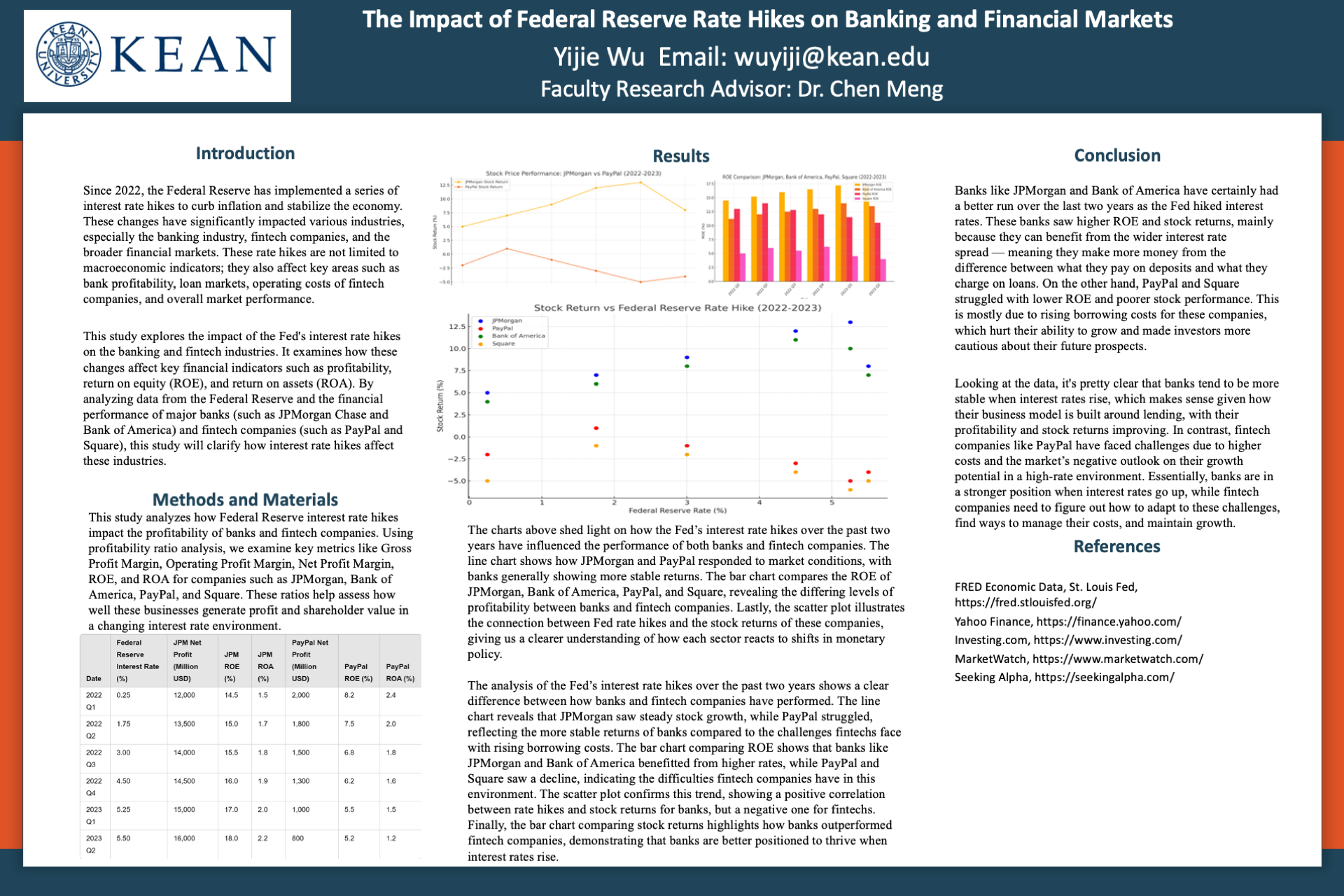

Since 2022, the Federal Reserve has raised interest rates multiple times to control inflation and stabilize the economy. These changes have had a significant impact on various industries, particularly banks and fintech companies. This study examines how these interest rate hikes have affected the performance of major banks like JPMorgan Chase and Bank of America, compared to fintech companies such as PayPal and Square. By analyzing key financial indicators, including profitability (ROE and ROA) and stock returns, this research explores the differences in how these sectors have responded to the changing market environment. The results show that banks have generally benefitted from higher rates due to increased profit margins from loan interest, while fintech companies have struggled with higher borrowing costs and investor caution. This research provides valuable insights into the differing impacts of interest rate hikes on traditional banking versus fintech, helping investors understand the risks and opportunities in each sector. Ultimately, the findings suggest that banks are in a stronger position during periods of rising rates, while fintech companies need to adjust their strategies to manage costs and maintain growth.