The Role of ETFs in Retirement Portfolios

Engels Batista Ruiz

Co-Presenters: Michael Mousa, Tyler Dilemma, Beka Kobauri

College: College of Business and Public Management

Major: Finance

Faculty Research Mentor: Bo Wang

Abstract:

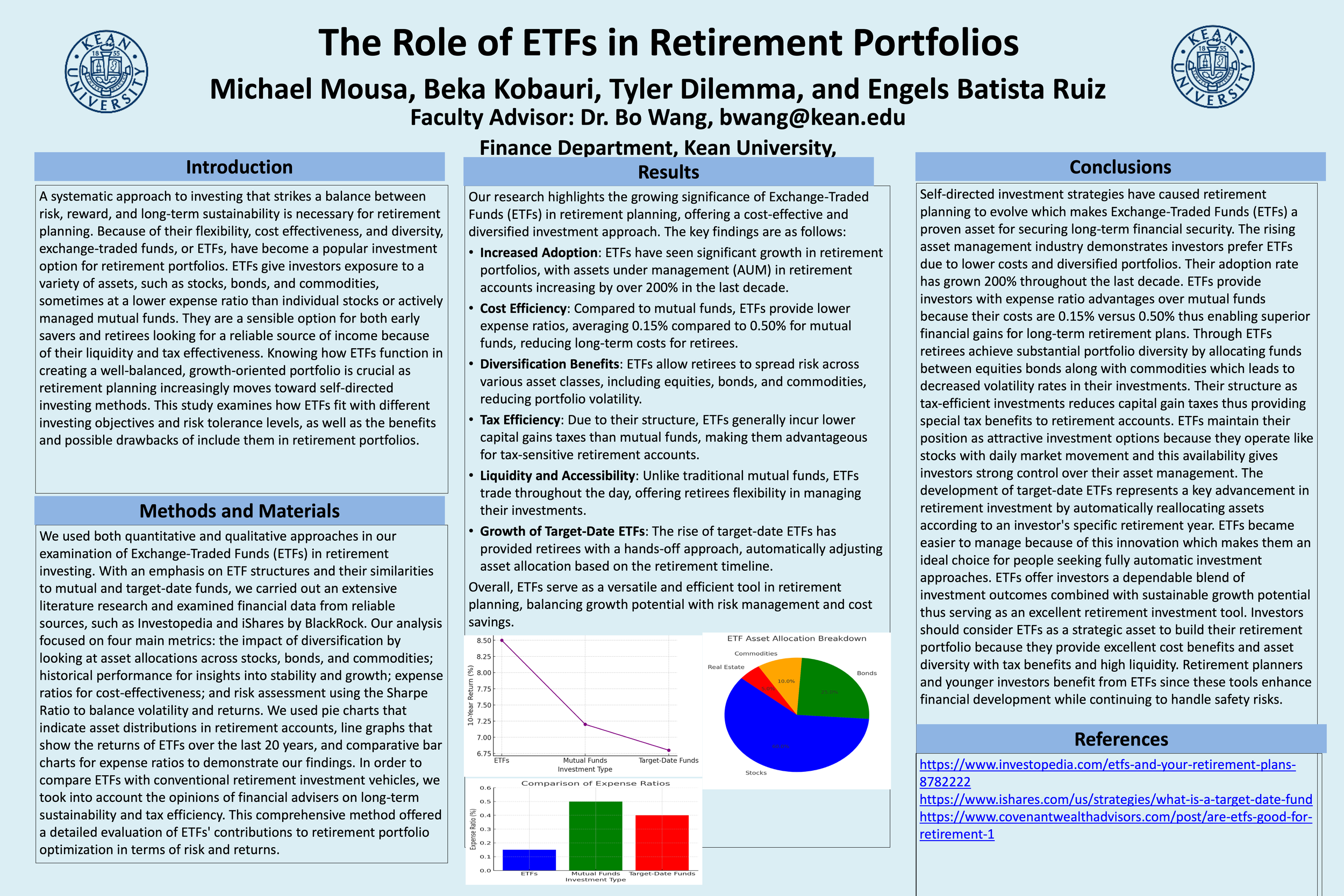

Because they provide a diversified and affordable investment strategy, exchange-traded funds, or ETFs, have emerged as a key component of contemporary retirement portfolios. This study examines the strategic use of exchange-traded funds (ETFs) in retirement planning, highlighting the advantages, drawbacks, and best allocation practices of these funds. Through diversification across asset classes, such as stocks, fixed income, commodities, and alternative assets, ETFs give retirees a wide range of market exposure. They are a desirable choice for long-term wealth growth due to their low expense ratios when compared to actively managed mutual funds. ETFs also provide excellent liquidity and tax efficiency, and their special formation and redemption process reduces capital gains taxes.Even with these benefits, there are risks associated with ETFs. Their performance may be impacted by market volatility, and certain ETFs—particularly leveraged or sector-specific funds—carry higher risks that might not be compatible with conservative retirement plans. Additionally, selecting the appropriate ETF necessitates a thorough analysis of variables including asset allocation, tracking error, and expense ratios. The difference between passive and active ETFs is also covered in this study, emphasizing how retirees can maximize risk-adjusted returns by balancing actively managed ETFs with inexpensive index funds. To offer a thorough approach to ETF-based retirement investment, strategies like dollar-cost averaging, rebalancing, and the utilization of bond ETFs for income production are investigated. To sum up, ETFs are a useful instrument for creating robust retirement portfolios since they provide flexibility, cost effectiveness, and wide diversification. Retirees can attain long-term financial security while effectively managing risks by comprehending their position and strategically integrating them into financial planning.