Active vs. Passive ETFs: Which Strategy Wins?

Congyi Zhang

Co-Presenters: Congyi Zhang, Krisztina Balogh, Pedro Vale, Andre Peixoto, Anthony Carlucci

College: College of Business and Public Management

Major: Finance

Faculty Research Mentor: Bo Wang

Abstract:

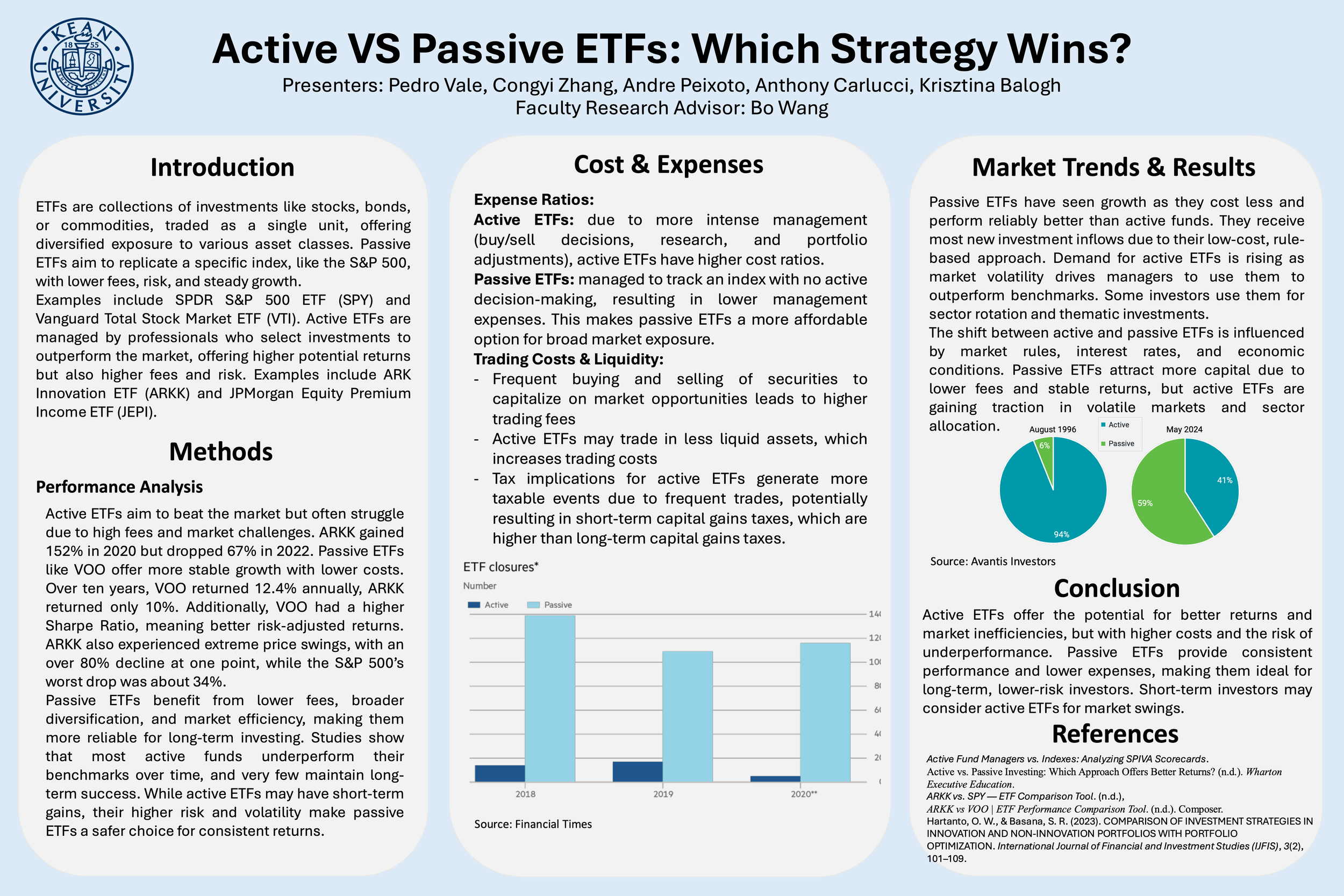

Exchange-Traded Funds (ETFs) have transformed the investment landscape by offering investors diversified exposure to financial markets. This study examines the ongoing debate between actively managed and passively managed ETFs, focusing on performance, cost structures, and investor preferences. While passive ETFs aim to track market indices with minimal costs, active ETFs seek to outperform the market through professional fund management. The key question remains: which strategy delivers superior results in terms of returns and risk-adjusted performance?This research utilizes a comparative analysis of select ETFs representing both strategies, assessing historical returns, expense ratios, and risk metrics such as standard deviation and Sharpe ratio. Case studies of specific funds provide insights into their effectiveness across different market conditions. Additionally, investor sentiment and preference trends are explored through survey data and fund flow analysis.Findings indicate that while passive ETFs generally provide cost-efficient market exposure with lower volatility, certain actively managed ETFs have demonstrated outperformance in specific sectors or during periods of market turbulence. However, higher fees associated with active management often erode excess returns. These insights contribute to the broader discussion on investment strategy selection, aiding individual and institutional investors in making informed decisions.

Keywords: ETFs, Active Management, Passive Investing, Fund Performance, Investment Strategy