An analysis of the Low-Leverage Strategy of Logitech

Zikun Xu

Co-Presenters: Individual Presentation

College: College of Business and Public Management

Major: Finance

Faculty Research Mentor: Andreas Kakolyris

Abstract:

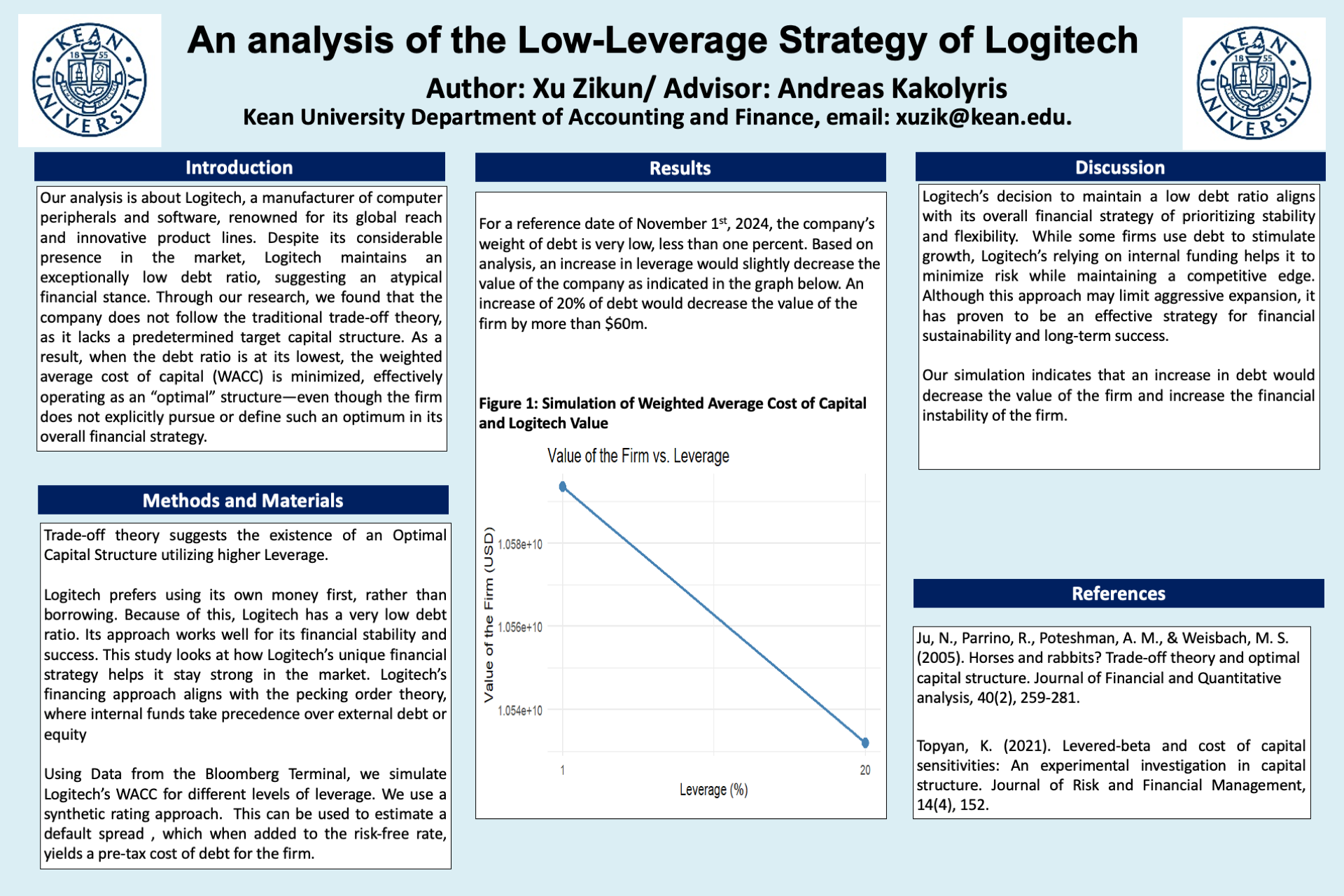

Our analysis is about Logitech, a manufacturer of computer peripherals and software, renowned for its global reach and innovative product lines. Despite its considerable presence in the market, Logitech maintains an exceptionally low debt ratio suggesting an atypical financial stance. Through our research, we found that the company does not follow the traditional trade-off theory, as it lacks a predetermined target capital structure. Instead, Logitech’s financing approach aligns with the pecking order theory, where internal funds take precedence over external debt or equity. As a result, when the debt ratio is at its lowest, the weighted average cost of capital (WACC) is minimized, effectively operating as an “optimal” structure—even though the firm does not explicitly pursue or define such an optimum in its overall financial strategy.