Comparing ETFs and Mutual Funds

Warren Francis

Co-Presenters: Alex Nieves, Jacob Shor, Chihao Xu

College: College of Business and Public Management

Major: Accounting

Faculty Research Mentor: Bo Wang

Abstract:

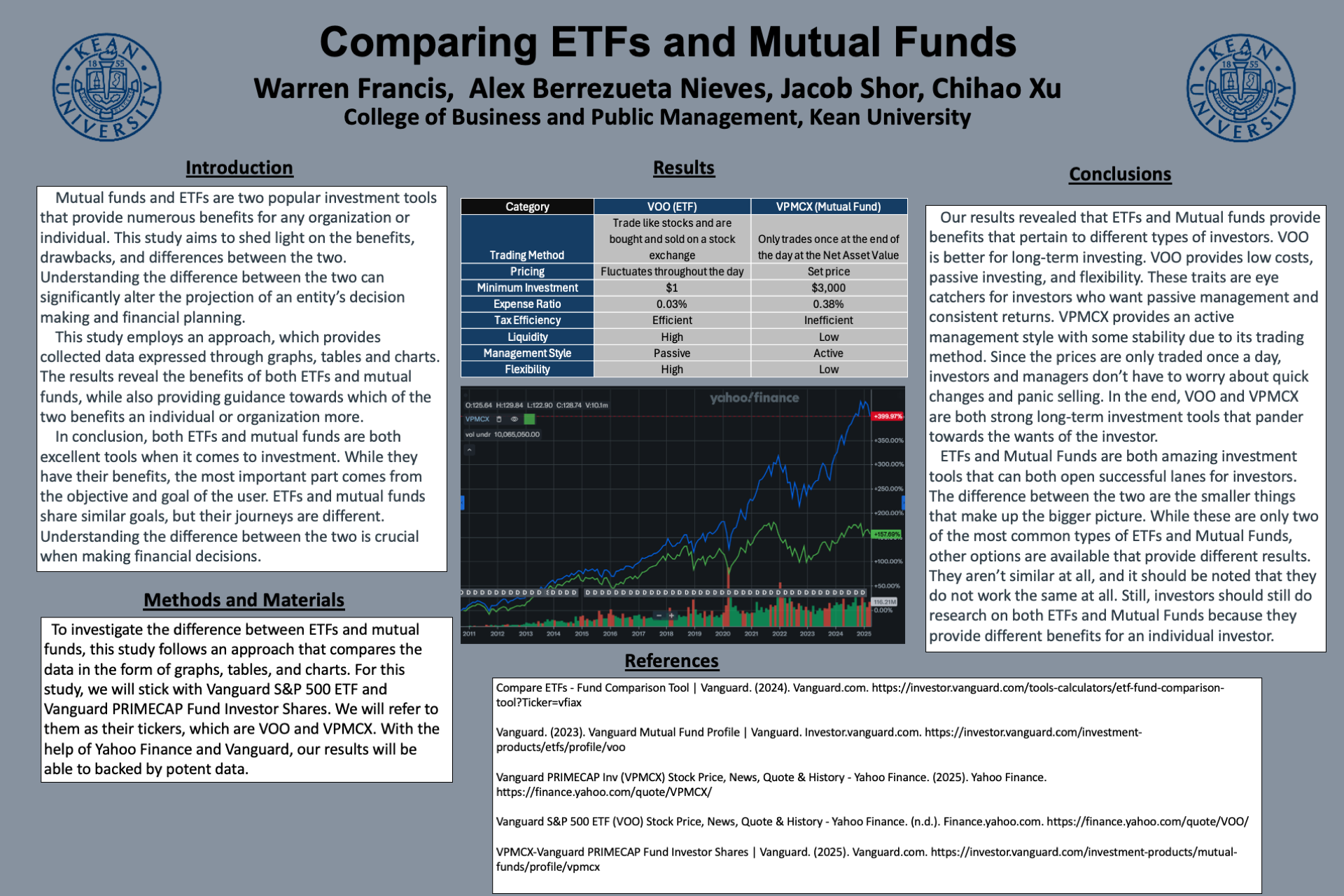

Investment funds like ETFs and mutual funds play a big part in the economy today. They offer people and organizations the ability to pool money for bigger projects, help diversify portfolios, and contribute to the growth of wealth. While they both support the users of investment funds, they differentiate in many ways. Understanding the difference between the two can significantly alter the projection of an entity's financial future. They differ in liquidity, transparency, pricing, and those are just a few differences. All these differences combined can significantly alter the projection of an individual or organization. The purpose of this study is to make people more informed about which route they should take, whether it be ETFs or mutual funds. We will investigate by monitoring ETFs and mutual funds, and how they've progressed. With the help of Yahoo Finance, we can track and analyze how they work in detail. By using historical data and analyzing aspects like liquidity and flexibility, our findings will provide a deeper insight on the difference between ETFs and mutual funds. As stated before, the difference between these two can determine how successful an organization or person can be.