ETF Taxation and Regulatory Issues

Bryan Carrasco

Co-Presenters: Ken Chen, Andrew McGinnis, Joseph Costa Penta

College: College of Business and Public Management

Major: Accounting

Faculty Research Mentor: Bo Wang

Abstract:

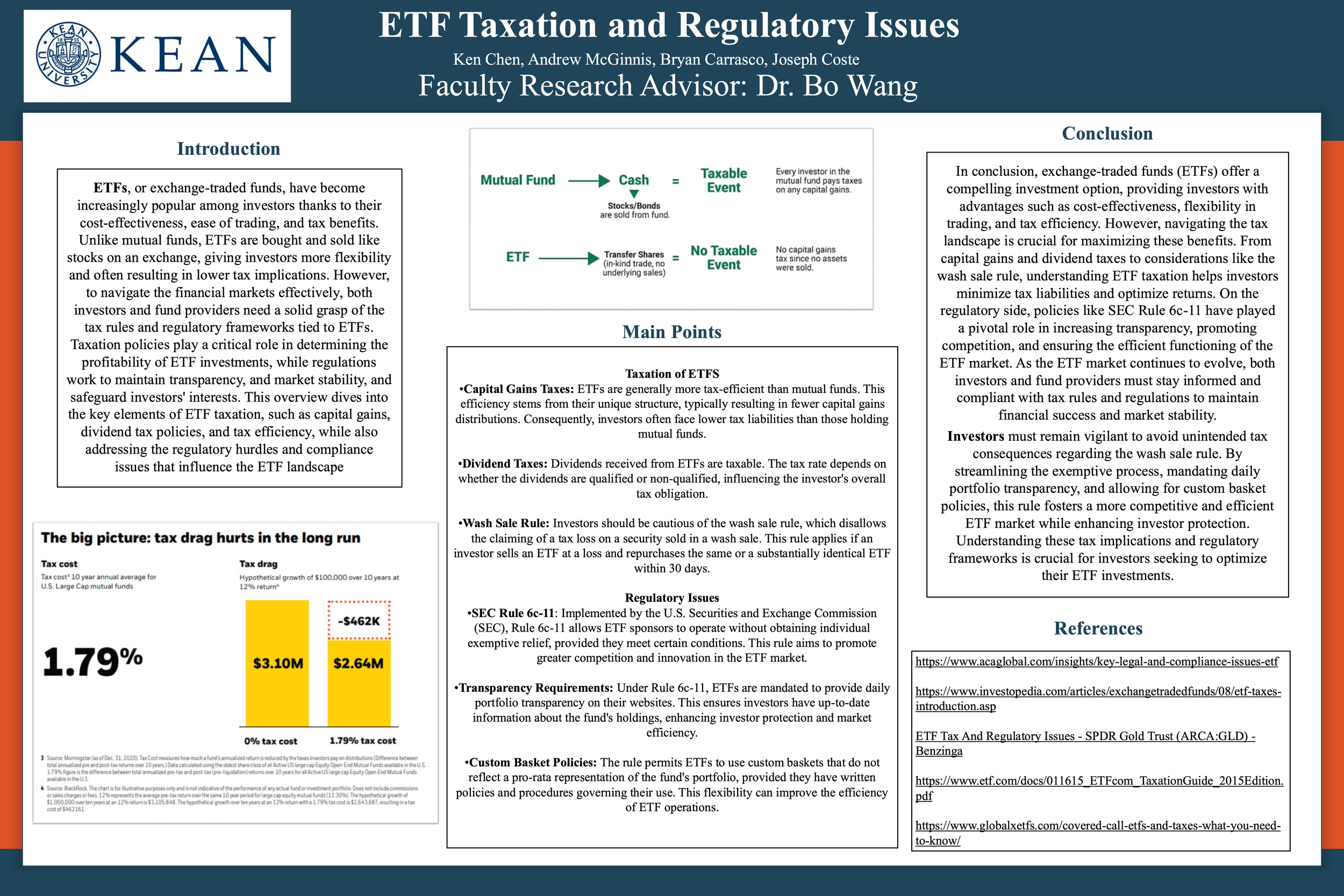

ETF Taxation and Regulatory Issues: Understanding the Impact on InvestorsExchange-Traded Funds (ETFs) have become a popular investment tool due to their low costs, diversification benefits, and ease of access to various markets. However, the complex taxation and regulatory rules surrounding ETFs can create challenges for investors and fund managers. This research explores the current tax policies and regulations governing ETFs and their impact on investment strategies and market dynamics. By reviewing existing studies, government tax codes, ETF prospectuses, and reports from financial regulators, the study highlights the gaps and inconsistencies in the current regulatory framework. Interviews with financial professionals provide additional insights into the practical challenges that investors face when navigating these rules. The findings suggest that the existing tax treatment of ETFs can result in uneven investment outcomes, particularly in cross-border transactions, and that the regulatory landscape is often unclear, leading to concerns about market fairness and investor protection. The research emphasizes the need for clearer, more consistent global tax policies and regulations that would simplify the process of investing in ETFs, improve market efficiency, and enhance investor confidence. The study also suggests that future research should focus on potential reforms to the tax and regulatory systems that could create a more transparent and equitable environment for ETF investments worldwide.

Keywords: ETF Taxation, Regulatory Issues, Investment, Financial Market, Investor Protection