Optimizing ExxonMobil's Capital Structure: A Mathematical Approach to Minimizing WACC and Maximizing Corporate Value

Yuanyumeng Zhu

Co-Presenters: Xinyu Zou Liang wang, Yuanyumeng Zhu, Liang wang

College: College of Business and Public Management

Major: Accounting

Faculty Research Mentor: Andreas Kakolyris

Abstract:

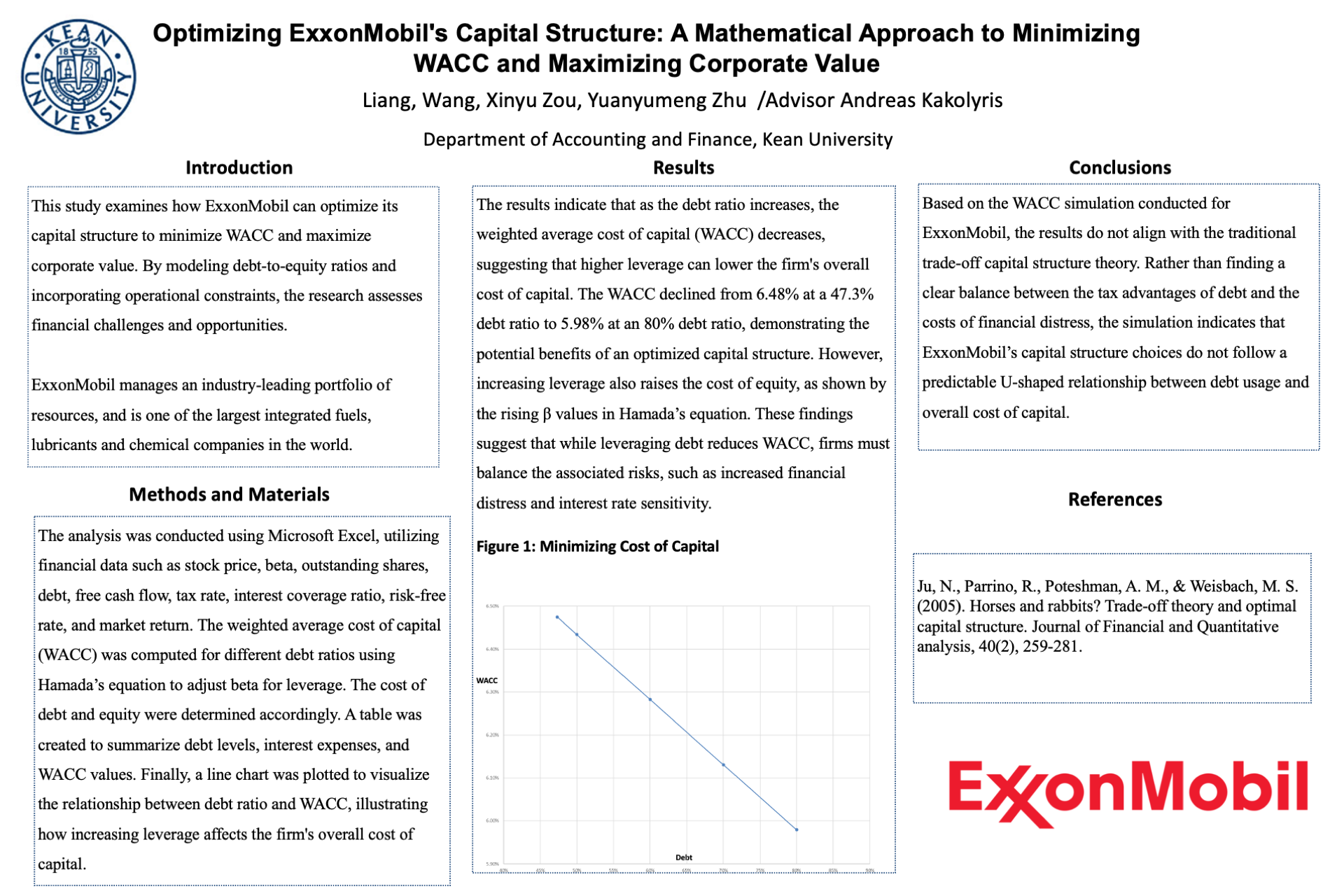

This study explores how ExxonMobil can adjust its capital structure to minimize the Weighted Average Cost of Capital (WACC) and maximize corporate value through mathematical modeling. Utilizing Python for financial analysis and the Gurobi optimizer for enhancements, this research focuses on the financial challenges and opportunities ExxonMobil faces when adjusting the ratios of debt to equity.By defining decision variables and constructing an objective function, this study simulates the impact of different capital structures on ExxonMobil’s WACC and market valuation. Incorporating constraints that might arise during actual operations, such as limits on debt ratios and compliance requirements for equity ratios, ensures the practical applicability of the model. The findings reveal that optimizing the capital structure can significantly reduce the company's cost of capital, enhance financial stability, and increase market competitiveness.Furthermore, the study includes a sensitivity analysis of market risks and interest rate fluctuations, thoroughly investigating how these external factors affect ExxonMobil's capital structure decisions. The research demonstrates that timely adjustments to the capital structure can not only mitigate market uncertainties but also capitalize on market fluctuations to create greater value for the company. These insights provide valuable guidance for ExxonMobil and other large corporations in formulating more scientifically sound financial strategies in the complex global economic environment.