Cryptocurrency and Stock Market: Assessing ROI and Volatility

Mike Barthelemy

Co-Presenters: Individual Presentation

College: College of Business and Public Management

Major: Finance

Faculty Research Mentor: Benito Sanchez

Abstract:

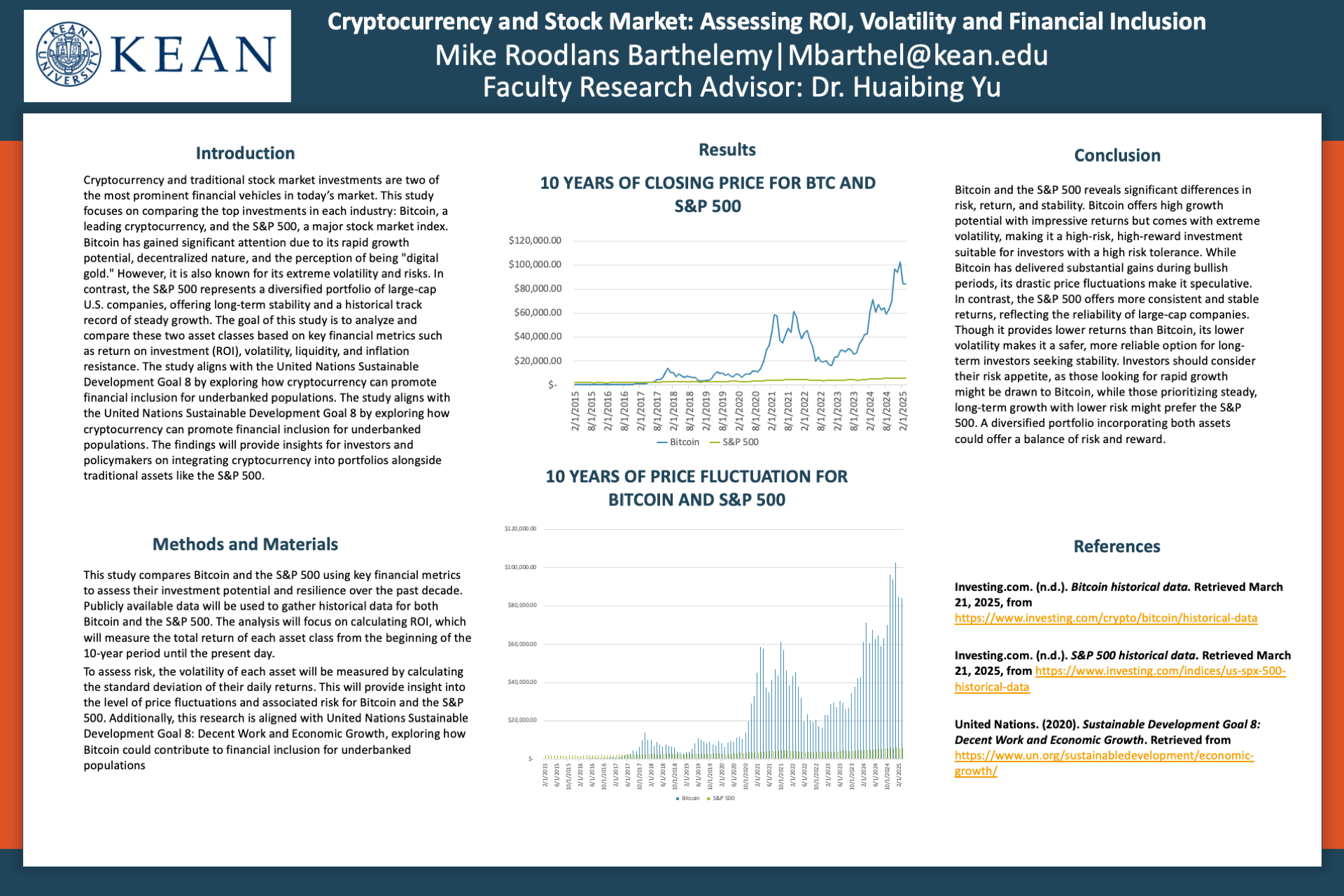

Cryptocurrency and the stock market are two of the most prominent investment vehicles in modern finance, each offering distinct advantages and risks. This study compares these asset classes by analyzing key financial metrics, including return on investment (ROI). The goal is to determine whether cryptocurrency can serve as a viable alternative or complement to traditional stock market investments. The stock market has long been regarded as a stable and structured investment option, backed by historical performance, corporate earnings, and government regulations. Assets such as blue-chip stocks, index funds, and dividend-paying stocks provide long-term growth with lower volatility. However, stock market returns are often tied to economic cycles, inflation, and monetary policies.In contrast, cryptocurrency offers decentralization, rapid growth potential, and higher accessibility, especially through blockchain technology and decentralized finance (DeFi). Bitcoin, often referred to as "digital gold," has outperformed many traditional assets over the past decade due to its scarcity and independence from central banks. However, cryptocurrencies are significantly more volatile, driven by speculation, regulatory uncertainty, and technological advancements.This study will conduct a comparative financial analysis of cryptocurrency and stock market performance, evaluating historical price trends, risk-adjusted returns, and market resilience during economic downturns. Additionally, this research aligns with United Nations Sustainable Development Goal 8: Decent Work and Economic Growth, as cryptocurrency has the potential to promote financial inclusion for underbanked populations. By examining both asset classes, this study will help investors, analysts, and policymakers understand the opportunities and risks of integrating cryptocurrency into a diversified investment portfolio. The findings will provide insights into whether cryptocurrency is a sustainable financial revolution or remains a speculative asset in comparison to the stock market.