Insurance decisions and risk attitudes: an application to China households.

Rui Sun

Co-Presenters: Jiaheng Zhang

College: College of Business and Public Management

Major: Accounting

Faculty Research Mentor: Andreas Kakolyris

Abstract:

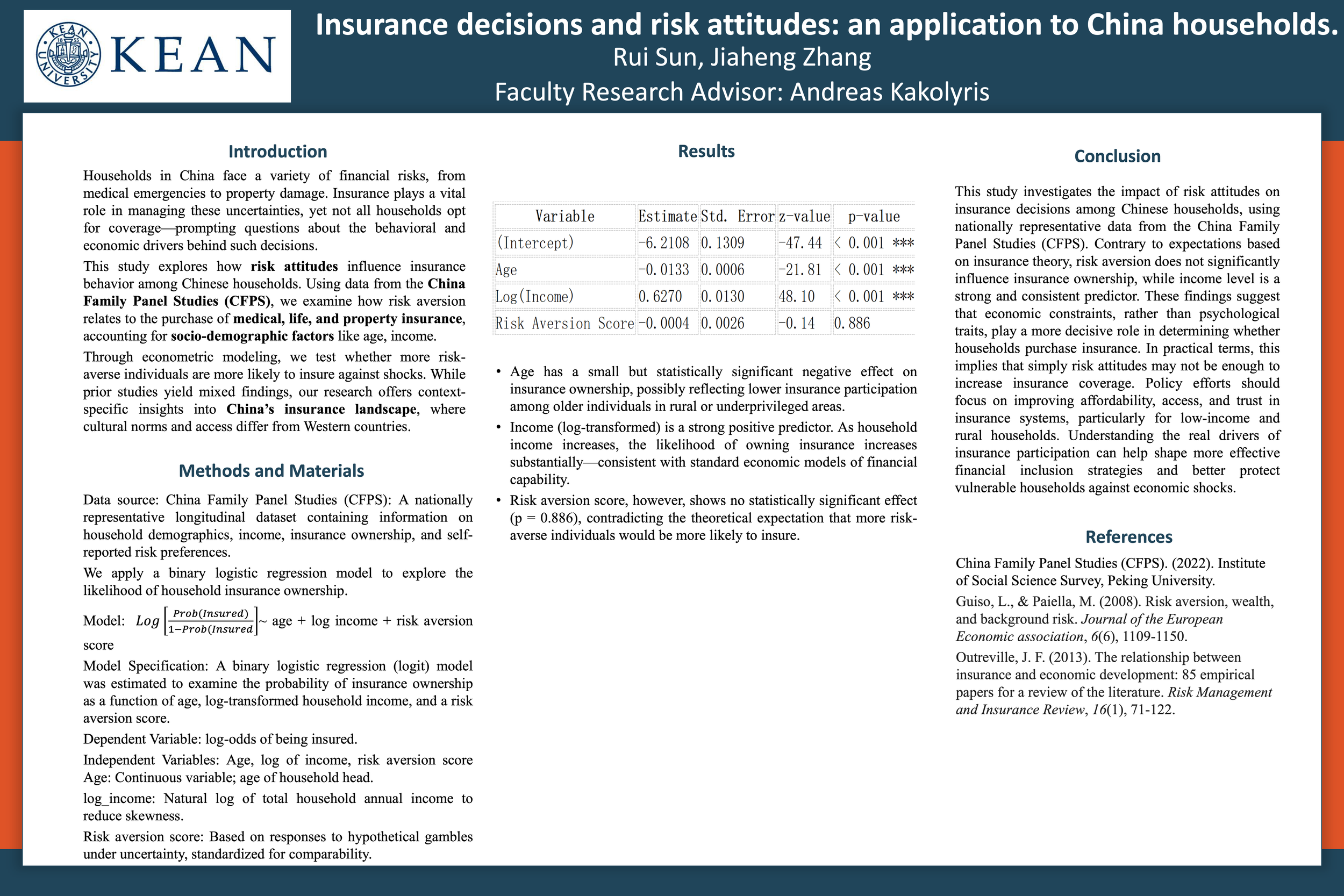

This study investigates how risk attitudes influence household insurance decisions in China, drawing on data from the China Family Panel Studies. By examining multiple forms of insurance coverage, including medical, life, and property insurance, we aim to uncover how households’ varying degrees of risk aversion shape their participation in formal and informal insurance arrangements. We incorporate socio-demographic and economic factors to contextualize risk preferences—capturing diverse household characteristics across urban and rural settings. Using econometric models that account for many household characteristics such as income, we assess the extent to which risk-averse households are more inclined to insure against financial shocks. We hypothesize, although the empirical literature is inconclusive, that risk aversion significantly affects insurance uptake, with more risk-averse individuals being more likely to purchase coverage. This research highlights how economic and demographic variables intersect with risk attitudes to shape financial decision-making, providing novel insights into the complexity of household insurance behavior in China.